Wednesday

Tuesday

repatriation

1. Flying sucks. At best, I felt like a peasant in a tyrannical monarchy. At worst, I felt like a pack animal. Upon check-in, there were two lines. Each had equal staffing and equal capacity. But one had 200 people in it, and the other had at most 2. The economy line was atrocious, snaking back and forth across the terminal in a formation that bore explicit resemblence to a cattle run. Dub over the chatter of aggravated passengers with mooing and you'd think you were in a slaughterhouse. There was even an attendent herding passengers in an effort to keep the vacant line for Priority Plus and Business class unobscured. I honestly wondered if she was going to require us peons to bow before the "royalty" strolling up the red carpet to the VIP counter. Let's hear it for socioeconomic stratification.

Even more disheartening is passenger behavior. When the flight attendants roll the service carts up the aisle, everybody lowers their traytable. I did it myself, and was instantly disgusted. Pavlov taught dogs to salivate at the sound of a bell. Delta taught humans to lower traytables at the sight of a food vessel. What's the difference?

2. I live a long, long way from home. Somehow, my transatlanticism had never really sunk in. I stared at my customs form and read "Country of Residence:" I hesitated and finally wrote "Denmark." I have no clue why, but it took that fact a solid few seconds to register.

Being back in the States is proving to be a great time. I've eaten the hell out of some food at every Mexican restaurant in the greater Chapel Hill area, rekindled my romantic flair with sweet tea, and caught a couple UNC games. There's been a recent dearth of blog-worthy material, but hopefully that changes soon. Until then...

Sunday

snowpenhagen

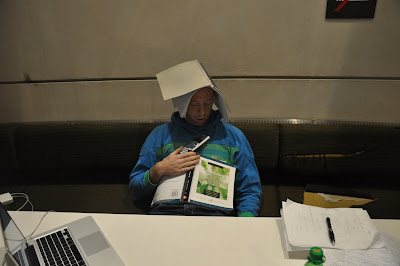

Thirty-six percent of Copenhagen's 1.2 million people commute to work by bike, and watching the otherwise immaculate and effortlessly confident Danes totter and tumble in the snow is proving immensely entertaining. Slightly less entertaining is the way I've spent the last two weeks...battered and bruised by body blows from business heavyweights Corporate Finance and Financial Markets and Instruments. Since I've been hunkered down in a study bunker most of the month, not a whole lot has happened worthy of mention. Jeppe's exasperated expression pretty much encapsulates December:

Thirty-six percent of Copenhagen's 1.2 million people commute to work by bike, and watching the otherwise immaculate and effortlessly confident Danes totter and tumble in the snow is proving immensely entertaining. Slightly less entertaining is the way I've spent the last two weeks...battered and bruised by body blows from business heavyweights Corporate Finance and Financial Markets and Instruments. Since I've been hunkered down in a study bunker most of the month, not a whole lot has happened worthy of mention. Jeppe's exasperated expression pretty much encapsulates December:

Friday

fmi? fml.

Question 6 (weight 20%)

You have estimated the Single Index model for two oil companies, Exxon Mobil Corp. (XOM) and Chevron Corp. (CVX), using monthly data of excess returns over the past five years. You have obtained the following results:

R(xom) = .58% + .57R(m) + e(xom) R^2(xom) = .22

1. What are the standard deviations of the monthly excess returns of CVX and XOM?

2. In the Single Index model, how much of the variance in CVX is due to its systematic component, and how much is due to its firm-specific component?

3. Find the correlation between the excess returns of CVX and XOM implied by the Single Index model

4. You have also directly estimated the correlation coefficient between the excess returns of CVX and XOM to be .78. Briefly explain in words what might account for the difference between the .78 and your answer in 3, and briefly describe how you might improve on the Single Index model to obtain a more precise correlation estimate between the two stocks.

Now, I had put more than 40 hours into studying for this 4-hour exam, and felt my knowledge of the subject matter unequivocally thorough. That having been said, here's an excerpt from my internal monologue upon reading this question:

Is this &*å@ in Danish or what? @$#*. Ok, let's analyze this. The ankle bone's connected to the...thigh bone. No wait, wrong subject. And that's not even correct! Thank God you didn't go into medicine. Although that's an interesting evolutionary proposition. What would people look like if ankles connected to thighs? Squat, undoubtedly, and no way our savanna-dwelling ancestors could have outrun cheetahs and other exotic creatures to survive and reproduce. Great job, Ben, your anatomical supposition would have led to the extinction of mankind. Ok, right, exam, focus...you're being retarded. Well, retarded actually wouldn't be all that bad...Rain Man could probably figure out this crap. And he could just go to Vegas and make a fortune anyways, no need for advanced financial degrees. Just Vegas, fish sticks, and K-mart underwear. No need to deviate from that. Deviate. Standard deviations of the monthly excess returns...you need the derivation of the R^2 formula to solve for that. R-squared. Finance is truly for squares. Heh, that's a pretty good one. Blanking on the formula derivation, so blanking it is.

I walked to the front of the class and joined about 65 other students in turning our papers in blank and leaving. Eye of the Tiger was replaced with a morose violin concerto. Denmark's re-exam system allows students who failed (or turned in blank) exams to try them again 2 months later, and I opted to take that route. I estimate I would have gotten a grade of 7 (average) had I completed the test, but I'm average in too many other respects (see: height, weight, hair color, eye color, etc.) to settle for average grades.

We shall meet again in February FM&I, and next time you won't be so fortunate.

Wednesday

can we kiwi?

The university is in a vibrant college town, Dunedin, of 123,000 people. The cricket grounds are manicured, the music scene is flourishing, and the beaches contain as many penguins as people. The problem is how to get there. Kayak.com currently lists one-way fares at around $1800 (9000 DKK) from Copenhagen to Dunedin, and the shortest flight duration I can find takes 35 hours and over 12,000 miles (19000 km) to reach its destination. Copenhagen has a street called Istedgade I could probably patrol to make some money, but I think my parents, the University of North Carolina, and I would all be ashamed that my business degree led to the purchase of a leopard-print skirt and some clear high heels.

And here's the final crux in this grandiose globetrotting concoction: When I leave the US on January 18th, I might not be back for 18 months. Due to the reversal of seasons in the southern hemisphere, I'll go straight from spring semester at CBS (ends in June) to spring semester at Otago (starts in July) and attempt to get a "summer" internship in Australia from Nov-Feb before writing my thesis. Still, it's hard to say no to New Zealand...especially when it looks like this: